A check is a payable on demand item.

This means it is negotiable as soon as it is written. Checks cannot be postdated (i.e., written for a future date). Some checks may be returned from the bank as "non-negotiable – stale dated" if the check is deposited six months after it is written or after the negotiable date on the check.

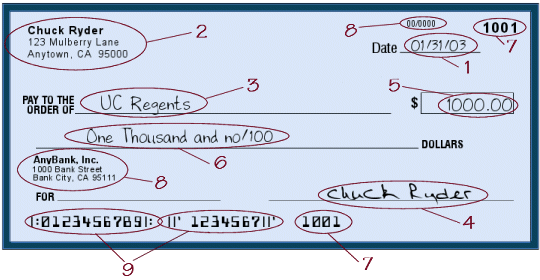

Fill out the check following the anatomy of a check below.

Anatomy of a Check

- Date is the date the check is written – cannot be a future date.

- Maker is the person/business who writes the check – the name will be printed on the check.

- Payee is the person/business to whom the check is written.

- Signature line or lines – two or more signatures can be required on a check.

- Written amount is the amount written in numbers.

- Legal amount is the amount written in words.

- Check number which is printed on the check and appears in the MICR line on the bottom of the check.

- Banking information is both the name on the bank and the American Banking Association number appearing on the check.

- Account and routing numbers – appear on the bottom of the check in the MICR line.